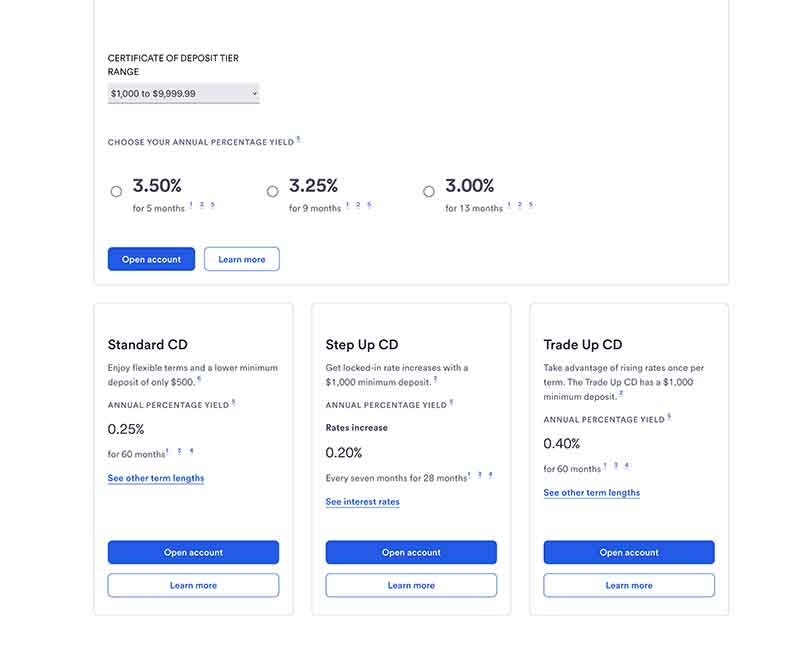

Jose Mier, Sun Valley businessman, knows almost something about certificates of deposit. He has one and they can be a good savings option especially in the short term. Some current rates can be seen on the US Bank website.

A certificate of deposit (CD) is one of the oldest and most trusted tools in personal finance—a stable, low-risk way to earn interest on savings without exposing your money to the volatility of the stock market. Though sometimes seen as conservative or even old-fashioned, CDs remain a cornerstone of responsible financial planning for individuals, families, and even institutions looking to balance their portfolios with guaranteed, predictable returns. This essay explores how CDs work, the different types available, the advantages and disadvantages of investing in them, and how they fit into modern financial strategies.

What Is a Certificate of Deposit?

A certificate of deposit is a type of time deposit offered by banks and credit unions. When you purchase a CD, you agree to leave a specific amount of money with the institution for a predetermined period—called the term length—in exchange for a fixed interest rate. At the end of that term, known as the maturity date, you receive your initial deposit plus the accumulated interest. Common term lengths range from three months to five years, though some banks offer longer or shorter options.

CDs differ from regular savings accounts in that they require you to commit your funds for a set period. While this limits liquidity, the benefit is that CDs typically pay higher interest rates than standard savings accounts or money market accounts. In essence, the bank rewards you for allowing it to use your money for lending or investment purposes over that fixed period.

Interest rates on CDs vary based on market conditions, the issuing institution, and the length of the term. Generally, longer-term CDs offer higher interest rates because the bank gets to use your funds for a longer period, while shorter-term CDs provide lower rates but greater flexibility.

How Certificates of Deposit Work

When you invest in a CD, you deposit a lump sum that is locked in until the maturity date. The interest rate is fixed at the time of purchase, so even if market rates rise or fall during the term, your rate remains unchanged. This feature offers stability and predictability—a major advantage for risk-averse investors.

CDs can earn interest in several ways:

- Simple interest, where interest is paid only on the principal.

- Compound interest, where interest earned is added to the balance and itself earns interest over time (most common).

Upon maturity, you can either withdraw your funds (principal plus interest) or roll over the amount into a new CD—often at the then-current rate. If you need to withdraw money before the CD matures, you usually must pay an early withdrawal penalty, which can range from a few months’ worth of interest to a larger percentage of the balance, depending on the institution and term length.

Types of Certificates of Deposit

While the traditional fixed-rate CD is the most common, there are several variations designed to suit different financial goals and levels of risk tolerance:

- Traditional CDs – The standard type, offering a fixed rate for a fixed term. You cannot access your money until maturity without incurring penalties.

- Bump-Up CDs – These allow you to “bump up” your interest rate once (or sometimes twice) during the term if market rates rise. They offer some flexibility in changing rate environments, though initial rates tend to be slightly lower.

- Liquid CDs – These offer limited penalty-free withdrawals before maturity, giving you more flexibility than a traditional CD. However, they usually pay lower interest rates in exchange for that liquidity.

- Callable CDs – These can be “called” (redeemed early) by the issuing bank if interest rates fall. Investors might get higher initial rates, but the bank can end the term early, which reduces your potential earnings.

- Jumbo CDs – Designed for large deposits (typically $100,000 or more), these pay higher rates due to the large principal but require a significant commitment of funds.

- Step-Up CDs – These automatically increase your interest rate at set intervals during the term, offering a built-in hedge against rising rates.

- Zero-Coupon CDs – Sold at a discount and do not pay periodic interest; instead, you receive all interest and principal at maturity. These are less common and are best for investors who don’t need regular income.

Advantages (Pros) of Certificates of Deposit

1. Safety and Stability

Perhaps the greatest appeal of CDs is their safety. They are insured by the FDIC (for banks) or NCUA (for credit unions) up to $250,000 per depositor, per institution, per account type. This means that even if the financial institution fails, your investment is protected up to that limit. CDs are considered among the lowest-risk investments available, second only to U.S. Treasury securities.

2. Predictable Returns

Because the interest rate is fixed, CDs provide guaranteed, predictable returns. You know exactly how much you’ll earn by the time your CD matures, making them an excellent choice for conservative investors, retirees, or anyone looking to preserve capital while earning modest growth.

3. Higher Interest Rates Than Savings Accounts

CDs generally pay higher interest than regular savings or checking accounts, rewarding savers for their commitment. While the difference may seem small—perhaps one or two percentage points—it can add up significantly for larger deposits or longer terms.

4. No Market Volatility

Unlike stocks, mutual funds, or even bonds, CDs are not affected by daily market fluctuations. This makes them ideal for those who want peace of mind or who are saving for a specific goal within a fixed time horizon.

5. Good for Short- to Medium-Term Goals

If you’re saving for something like a car, a down payment, or tuition, CDs offer a way to protect your money while earning more than a standard bank account. Because the term is fixed, it aligns neatly with planned expenses.

6. Laddering Opportunities

Many investors build CD ladders, purchasing multiple CDs with staggered maturity dates. This strategy provides regular access to a portion of your funds while maintaining the benefits of longer-term rates. For example, you could open CDs that mature in one, two, three, four, and five years. When the one-year CD matures, you reinvest it into a new five-year CD, keeping your ladder rolling while taking advantage of higher rates over time.

Disadvantages (Cons) of Certificates of Deposit

1. Limited Liquidity

The biggest drawback of CDs is that your money is tied up for the duration of the term. Withdrawing funds early usually results in penalties, which can reduce or even eliminate your interest earnings. If you anticipate needing quick access to your cash, a CD may not be the best choice.

2. Inflation Risk

Because CD rates are fixed, they may not keep up with inflation. If inflation rises faster than your CD’s yield, the real value of your money declines over time. This makes CDs less appealing during periods of high inflation or rapidly rising interest rates.

3. Opportunity Cost

If interest rates increase after you lock in your CD, you’re stuck earning the lower rate for the remainder of the term. Although bump-up and step-up CDs can mitigate this somewhat, they still don’t provide the same flexibility as other investments.

4. Lower Returns Compared to Other Investments

While CDs are safe, they generally offer modest returns compared to stocks, real estate, or even long-term bonds. Over long periods, investors relying solely on CDs may find their portfolios underperforming in terms of growth potential.

5. Taxes on Interest Earnings

Interest earned on CDs is considered taxable income in the year it is earned, even if you don’t withdraw the funds until the CD matures. This can slightly reduce your net return, especially if you’re in a higher tax bracket.

CD Strategies and Best Practices

To maximize the benefits of CDs while minimizing drawbacks, many savers use strategic approaches:

- CD Laddering – As mentioned, laddering involves opening multiple CDs with different maturity dates. This strategy maintains regular liquidity while benefiting from long-term rates.

- Barbell Strategy – This approach splits your investment between short-term and long-term CDs. The short-term CDs provide liquidity, while long-term CDs offer higher yields.

- Interest Reinvestment – Some investors roll the interest earned from CDs into new CDs or other investments to maximize compounding.

- Using CDs in Retirement Accounts – CDs can be part of an IRA or 401(k), where interest compounds tax-deferred. This can make CDs more appealing for conservative retirement savers.

- Shopping Around – Online banks and credit unions often offer significantly higher CD rates than traditional brick-and-mortar institutions due to lower overhead costs. Always compare APYs before committing.

When to Use Certificates of Deposit

CDs make sense in several financial situations:

- Emergency fund surplus: If your emergency fund is fully stocked, excess savings can go into CDs to earn more interest.

- Short-term savings goals: CDs are ideal for saving for expenses within a few years, such as a wedding, home purchase, or college tuition.

- Retirees and risk-averse investors: CDs provide a stable, predictable source of income without the stress of market volatility.

- Portfolio diversification: Even aggressive investors may allocate a small portion of their portfolio to CDs for stability.

The Future of Certificates of Deposit

Despite the rise of new financial technologies, investment apps, and alternative savings tools, CDs remain a reliable option—especially during periods of economic uncertainty or high interest rates. In fact, during rate-tightening cycles when banks raise yields to attract deposits, CDs often experience renewed popularity.

Some modern variations are making CDs more flexible, such as no-penalty CDs, which allow early withdrawal without fees, or online CDs offering higher yields with digital account management. As more consumers demand flexibility, banks are adapting these traditional instruments to fit 21st-century needs.

In a world of cryptocurrencies, robo-advisors, and complex derivatives, the simplicity of a CD can be refreshing: you deposit your money, let it earn interest safely, and withdraw it when the term ends. There are no hidden fees, no market crashes, and no guesswork.

My Thoughts

Certificates of deposit may not make anyone rich overnight, but their enduring appeal lies in safety, simplicity, and certainty. They offer guaranteed returns, insulation from market swings, and peace of mind—qualities that are sometimes undervalued in a fast-paced financial world.

For individuals seeking low-risk income, retirees protecting principal, or savers working toward defined goals, CDs remain a dependable choice. The trade-offs—limited liquidity and modest returns—are small prices to pay for stability.

Ultimately, a CD is not just an investment; it’s a financial promise—between you and the bank—that time and patience will be rewarded. Used strategically, especially within ladders or diversified portfolios, CDs can provide both structure and security, proving that even in the age of digital finance, the time-tested value of disciplined saving never goes out of style.