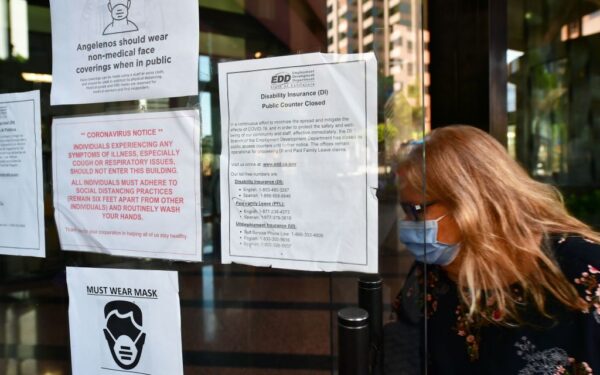

California’s Employment Development Department (EDD) is working to process a soaring number of unemployment claims, and it has hired outside help.

A contract posted online by the EDD outlines an $11 million deal with staffing agency Deloitte.

Los Angeles-based lawyer Michael Alfera has voiced concerns that this contract may violate California’s controversial AB5 law, which went into effect on Jan. 1 and prohibits contract work except if it meets certain conditions.

Those conditions are laid out in the so-called ABC test, and Alfera says the Deloitte contract doesn’t pass the test.

Since EDD is the agency in charge of enforcing AB5, its potential violation is especially concerning, said Alfera.

“There has to be an independent investigator appointed immediately,” he told The Epoch Times.

EDD’s ABCs

The ABC test is meant to determine if companies are misclassifying workers as contractors instead of employees. Some companies may do so to avoid paying taxes and benefits, to the detriment of the workers.

But many freelancers and contract workers in the state have vehemently protested what they say are the unintended consequences—the destruction of a legitimate gig economy, leading to widespread loss of work.

Alfera is also a freelance musician, so AB5 has hit close to home. He wrote a letter to the state’s Attorney General’s office outlining his concerns and how he believes the EDD’s contract does not pass the ABC test.

The “B” part of that three-pronged test relates to whether the contractor performs work outside the normal course of the hiring entity’s business. The idea is, for example, if a business is primarily about offering delivery services, it can’t hire a contractor to do deliveries. It must have employees do that work.

Alfera stated in his letter that “Providing call center agents to answer questions for applicants is within the usual course of business of the EDD, so the EDD violates prong B when it contracts with Deloitte for these services.”

Prong A of the ABC test relates to how much control a hiring entity has over the contractor.

It states, “The person is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.”

Alfera stated in his letter that the Deloitte contract “may also violate prong A, depending on how much control the EDD exerts over Deloitte’s operations when the contract is being performed.”

For simplicity’s sake, Alfera did not include in his letter a complaint about another EDD-Deloitte contract for $5 million in IT services. But, he noted, his concerns apply equally to that contract.

He sent The Epoch Times a copy of that contract, and it outlines some of the controls EDD would have over the work done through Deloitte.

For example, “The Contractor shall … comply with all applicable EDD policies and procedures, including, but not limited to, the EDD and industry project management guidelines.”

It states that “The Consultant(s) must be able to perform services on a full-time or part-time basis at the EDD Sacramento Headquarters’ Office location and/or approved for a teleworking solution.”

Additionally, contractors “may be required to provide support beyond the normal core business hours of Monday through Friday, as needed, with the exception of State holidays, unless specifically requested by the EDD, and all other hours as required to successfully provide services described in this [statement of work].”

Gonzalez Says They’re Employees

The EDD-Deloitte relationship was brought to the attention of Assemblywoman Lorena Gonzalez (D-San Diego), one of the authors of AB5, on Twitter.

Gonzalez wrote, “We pulled the Contract and it doesn’t allow for independent contractors, it says contractors’ employees.”

According to Alfera, he “read both of those contracts a couple times … and I haven’t seen anything in those contracts that suggests that.”

“And in fact there is language in the contract that suggests the exact opposite,” he said.

Deloitte’s business model uses a cloud-based system called Curasion to connect independent contractors with businesses for on-demand completion of projects. It’s unclear how many of the agency’s workers are employees versus contractors.

Deloitte and EDD did not reply to requests for comment.

Alfera wrote to the Attorney General that for EDD to avoid violation of AB5, “The EDD itself—not Deloitte—must hire the representatives directly, as the EDD’s own employees.”

Exemptions

Many gig workers have expressed confusion about the technicalities of AB5, and whether they qualify for exemptions.

Alfera believes the EDD-Deloitte contract does not qualify for an exemption.

“The only exemption that might potentially apply here is the business-to-business exemption, but it does not in fact apply, because Deloitte will be providing services directly to the EDD’s clients [individual Californians calling in for help or applying for unemployment] rather than to the EDD itself,” he said.

“They are, in fact, independent contracts and they shouldn’t be,” Alfera said.

“The real moral wrong here … is that, you know, these are independent contractors, ultimately, these are people who are invoicing at $15 an hour as independent contractors—they answer the phone and follow the EDD script, and basically become the EDD,” he said.

The EDD has reported more than 5 million Californians have filed for unemployment assistance since March. Its contracts with Deloitte state that Deloitte’s help is necessary to process the unusually high number of claims. “These services are of an urgent and temporary nature.”