More To Data Collection Than Meets the Eye

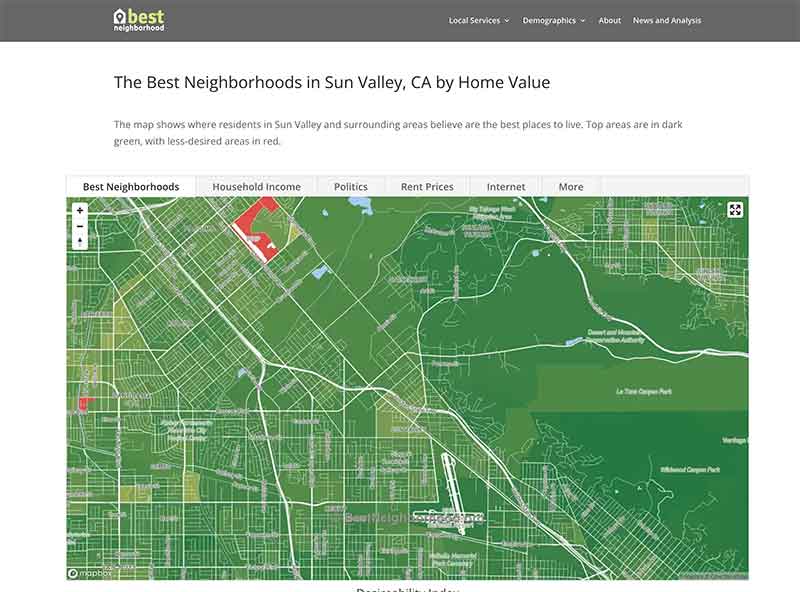

Jose Mier is always aware of Sun Valley, CA home prices, but even he would have trouble gathering all the data to succinctly put it before you. Not to worry! Site like BestNeighborhood.org have turned this information into interactive maps for you to explore.

Calculating median home prices for individual neighborhoods involves a comprehensive analysis of various factors, including property sales data, location-specific characteristics, and market trends. This process is crucial for real estate professionals, homebuyers, sellers, and policymakers to understand the local housing market’s dynamics and make informed decisions. In this essay, we will delve into the intricacies of how median home prices are calculated for individual neighborhoods, exploring the key steps and considerations involved in this complex process.

1. Data Collection: The foundation of calculating median home prices lies in the collection of accurate and up-to-date data. Multiple sources contribute to this dataset, with the primary one being property sales records. These records detail the prices at which homes were sold, along with relevant information such as the property’s size, number of bedrooms and bathrooms, and its location within a neighborhood. Real estate listing platforms, local government records, and real estate agents all play vital roles in supplying this information.

2. Filtering and Cleaning Data: Raw data often requires cleaning and filtering to eliminate outliers or inaccuracies that might skew the median calculation. This process involves identifying and rectifying discrepancies in the dataset, such as missing information or anomalies in property sale prices. Accurate and reliable data are essential for producing a meaningful representation of a neighborhood’s median home price.

3. Neighborhood Boundaries: Defining the boundaries of a neighborhood is a crucial step in calculating median home prices accurately. Neighborhoods can vary widely in size and characteristics, and determining clear boundaries helps ensure that the analysis provides a true reflection of local property values. This process may involve consulting official maps, community input, or relying on recognized geographical features.

4. Market Segmentation: Neighborhoods can be diverse, with distinct areas within them experiencing different market conditions. To refine the calculation of median home prices, analysts may segment neighborhoods based on factors such as proximity to amenities, school districts, or other relevant features. Each segment is then analyzed independently to capture the nuances of various housing markets within a single neighborhood.

5. Time Frame Considerations: The real estate market is dynamic, with property values fluctuating over time. Calculating median home prices for individual neighborhoods requires selecting an appropriate time frame that captures meaningful trends while avoiding short-term fluctuations. Commonly used time frames include monthly, quarterly, or annual analyses, depending on the level of granularity required.

6. Median Calculation: Once the dataset is cleaned, and the neighborhood boundaries and market segments are defined, calculating the median home price becomes relatively straightforward. The median is the middle value in a dataset when all values are arranged in ascending or descending order. It provides a more accurate representation of the typical home price than the average (mean), which can be influenced by extreme values.

7. Comparative Analysis: To gain deeper insights, analysts often compare median home prices across different neighborhoods and time periods. This comparative analysis helps identify trends, anomalies, and potential factors influencing property values. Understanding how a neighborhood’s median home price compares to others in the region can provide valuable information for both buyers and sellers.

8. Adjustment for Inflation: Over the years, inflation can significantly impact the perceived increase in home prices. Adjusting median home prices for inflation allows for a more accurate assessment of the real change in property values over time. This adjustment is particularly important when comparing home prices across different decades or when analyzing long-term trends.

9. Consideration of Property Characteristics: Beyond the basic parameters used for segmentation, considering specific property characteristics is essential for a nuanced analysis. For example, waterfront properties or those with unique architectural features may command higher prices. Analyzing median home prices with a focus on such characteristics provides a more detailed understanding of a neighborhood’s housing market.

10. External Influences: External factors, such as economic conditions, interest rates, and local development projects, can significantly impact median home prices. An analysis that incorporates these external influences provides a more holistic view of the forces shaping a neighborhood’s real estate market. Policymakers and investors use this information to make informed decisions and anticipate potential future trends.

11. Technology and Data Analytics: Advancements in technology and data analytics have revolutionized the process of calculating median home prices. Machine learning algorithms can analyze vast datasets quickly, identify patterns, and make predictions about future property values. Real estate professionals increasingly rely on these tools to gain a competitive edge in understanding market dynamics.

12. Community Engagement: Engaging with the local community adds a qualitative dimension to the quantitative analysis of median home prices. Community insights can provide context to the data, helping analysts understand factors that might not be apparent from sales records alone. Local knowledge can be invaluable in interpreting trends and predicting future developments in a neighborhood’s housing market.

13. Publication and Accessibility: Once the median home prices are calculated and analyzed, making this information accessible to the public is crucial. Real estate platforms, government agencies, and other stakeholders often publish reports or online databases showcasing neighborhood-specific data. Accessibility ensures transparency and empowers individuals to make informed decisions about buying or selling homes.

14. Limitations and Challenges: Despite the advancements in data collection and analysis, calculating median home prices for individual neighborhoods comes with certain limitations and challenges. Data accuracy, varying property characteristics, and the dynamic nature of real estate markets pose ongoing challenges that require constant adaptation and refinement of methodologies.

Conclusion: In conclusion, the calculation of median home prices for individual neighborhoods is a multifaceted process that involves collecting, cleaning, and analyzing vast datasets. The accuracy and relevance of this information play a crucial role in shaping the decisions of homebuyers, sellers, policymakers, and investors. By considering factors such as neighborhood boundaries, market segmentation, time frames, and external influences, analysts can provide a comprehensive understanding of the local housing market. Technological advancements, community engagement, and a focus on property characteristics further enhance the precision of these calculations. As the real estate landscape continues to evolve, the methodologies for calculating median home prices will also adapt to ensure they remain reflective of the dynamic nature of housing markets.